消(53):零售业消费税指南 (GUIDE ON RETAILING) ~ 1

消(54):零售业消费税指南 (GUIDE ON RETAILING) ~ 2 (价格展示 Price Display 定价 Pricing 建议零售价 Recommended Retail Price,RRP)

消(58):零售业消费税指南 (GUIDE ON RETAILING) ~ 3 (简化版税务发票 Simplified Tax Invoice 综合供应与混合供应 Composite Supply & Mixed Supply)

消(60):零售业消费税指南 (GUIDE ON RETAILING) ~ 4 (促销与礼品 Treatment for Promotions & Gifts)

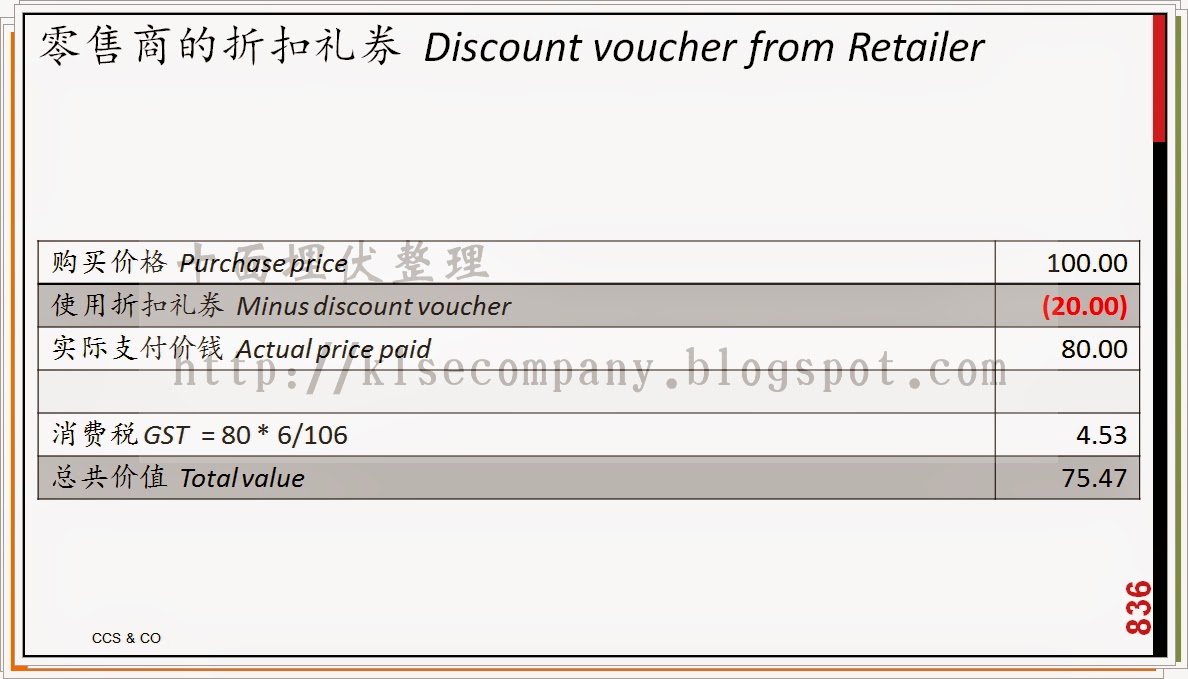

消(61):零售业消费税指南 (GUIDE ON RETAILING) ~ 5 (礼券、固本、印章、筹码 Retail Vouchers, Coupons, Stamps & Tokens)

公司网站 - https://www.ccs-co.com/ 当你以我们的视频及刊物上的内容作为参考时,你需要: 查询相关资料是否依然合时、准确和完整;和 寻求本身独立的专业意见,因为各别案例所涉及的范围和层面皆不同。 When you apply the content in our videos and publications as a reference, you need to: check the information contained therein whether it’s up-to-date, accurate and complete, and seek your own independent professional advice, this is because the scope and extent involved in each individual case are different.

Subscribe to:

Post Comments (Atom)

请问,如果我去买一台手机售价1060包含6%GST给我的员工,RM60的GST我可以claim 回吗?是可claim RM60还是RM30?

ReplyDeleteNG KHA CHING,

Delete如果你拿到 full tax invoice 就claim 60。

如果你拿到的是simplified tax invoice,就claim 30.

当你把手机送给员工时,注意一下礼物法则。