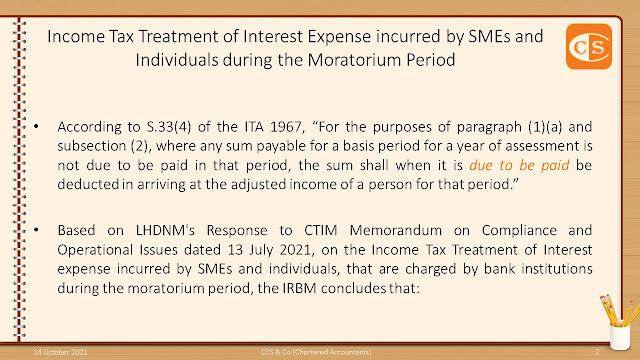

1. According to S.33(4) of the ITA 1967, “For the purposes of paragraph (1)(a) and subsection (2), where any sum payable for a basis period for a year of assessment is not due to be paid in that period, the sum shall when it is due to be paid be deducted in arriving at the adjusted income of a person for that period.”

2. Based on LHDNM's Response to CTIM Memorandum on Compliance and Operational Issues dated 13 July 2021, on the Income Tax Treatment of Interest expense incurred by SMEs and individuals, that are charged by bank institutions during the moratorium period, the IRBM concludes that: ........ [Please refer to the slide]

🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼

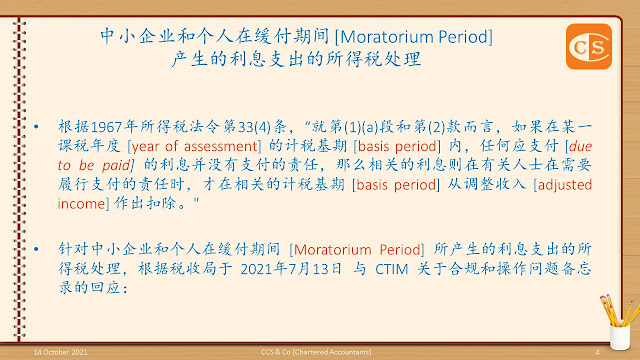

1. 根据1967年所得税法令第33(4)条,“就第(1)(a)段和第(2)款而言,如果在某一课税年度 [year of assessment] 的计税基期 [basis period] 内,任何应支付 [due to be paid] 的利息并没有支付的责任,那么相关的利息则在有关人士在需要履行支付的责任时,才在相关的计税基期 [basis period] 从调整收入 [adjusted income] 作出扣除。"

2. 针对中小企业和个人在缓付期间 [Moratorium Period] 所产生的利息支出的所得税处理,根据税收局于 2021年7月13日 与 CTIM 关于合规和操作问题备忘录的回应:.... [参考图解]

3. 下载阅读 - https://www.ccs-co.com/publications

#税务之道博大精深,#建议深度学习

🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳

👉 专业资讯送到你手中

1. 网站 ✍️ https://www.ccs-co.com/

2. Telegram ✍️ http://bit.ly/YourAuditor

3. Instagram ✍ http://tiny.cc/rojzrz

4. 部落格 ✍ https://ccsyourauditor.blogspot.com/

5. Google ✍ http://tiny.cc/9oussz

2. Telegram ✍️ http://bit.ly/YourAuditor

3. Instagram ✍ http://tiny.cc/rojzrz

4. 部落格 ✍ https://ccsyourauditor.blogspot.com/

5. Google ✍ http://tiny.cc/9oussz

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.