1. We would like to remind taxpayers who receive the grant and/or subsidy:

👉 to pay attention to how the grant and/or subsidy are treated

👉 since the Subsidy Wages that employers get under the Wage Subsidy Programs are a kind of government assistance.

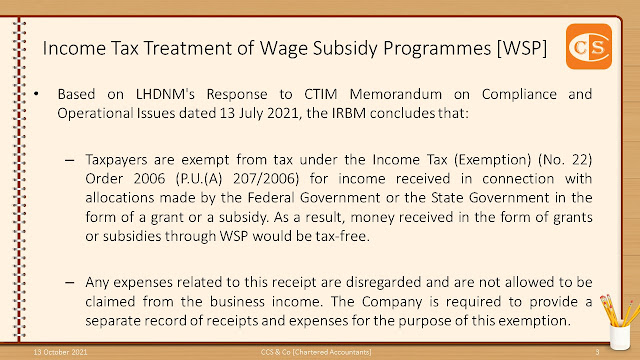

2. Taxpayers are exempt from tax under the Income Tax (Exemption) (No. 22) Order 2006 (P.U.(A) 207/2006) for income received in connection with allocations made by the Federal Government or the State Government in the form of a grant or a subsidy.

👉 As a result, money received in the form of grants or subsidies through WSP would be tax-free.

🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼

1. 我们想提醒领取工资补贴的纳税人 [雇主]:

👉 雇主在工资补贴方案下获得的补贴工资是政府提供的援助。

👉 因此,税务上的处理,不得不注意

2. 根据2006年所得税 (豁免)(第22号) 指令 [P.U.(A) 207/2006],纳税人因联邦政府或州政府以赠款或补贴形式提供的拨款而获得的收入/补贴/援助,豁免纳税。

👉 to pay attention to how the grant and/or subsidy are treated

👉 since the Subsidy Wages that employers get under the Wage Subsidy Programs are a kind of government assistance.

2. Taxpayers are exempt from tax under the Income Tax (Exemption) (No. 22) Order 2006 (P.U.(A) 207/2006) for income received in connection with allocations made by the Federal Government or the State Government in the form of a grant or a subsidy.

👉 As a result, money received in the form of grants or subsidies through WSP would be tax-free.

🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼

1. 我们想提醒领取工资补贴的纳税人 [雇主]:

👉 雇主在工资补贴方案下获得的补贴工资是政府提供的援助。

👉 因此,税务上的处理,不得不注意

2. 根据2006年所得税 (豁免)(第22号) 指令 [P.U.(A) 207/2006],纳税人因联邦政府或州政府以赠款或补贴形式提供的拨款而获得的收入/补贴/援助,豁免纳税。

👉 因此,通过工资补贴方案收到的金钱援助是不被征税的。

3. 下载阅读 - https://www.ccs-co.com/publications

#税务之道博大精深,#建议深度学习

🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳

👉 专业资讯送到你手中

1. 网站 ✍️ https://www.ccs-co.com/

2. Telegram ✍️ http://bit.ly/YourAuditor

3. Instagram ✍ http://tiny.cc/rojzrz

4. 部落格 ✍ https://ccsyourauditor.blogspot.com/

5. Google ✍ http://tiny.cc/9oussz

#税务之道博大精深,#建议深度学习

🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳

👉 专业资讯送到你手中

1. 网站 ✍️ https://www.ccs-co.com/

2. Telegram ✍️ http://bit.ly/YourAuditor

3. Instagram ✍ http://tiny.cc/rojzrz

4. 部落格 ✍ https://ccsyourauditor.blogspot.com/

5. Google ✍ http://tiny.cc/9oussz

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.