公司网站 - https://www.ccs-co.com/ 当你以我们的视频及刊物上的内容作为参考时,你需要: 查询相关资料是否依然合时、准确和完整;和 寻求本身独立的专业意见,因为各别案例所涉及的范围和层面皆不同。 When you apply the content in our videos and publications as a reference, you need to: check the information contained therein whether it’s up-to-date, accurate and complete, and seek your own independent professional advice, this is because the scope and extent involved in each individual case are different.

Friday, October 8, 2021

Issue No. 68/2021 : Tax Treatment on Final Tax [最终税的税务处理]

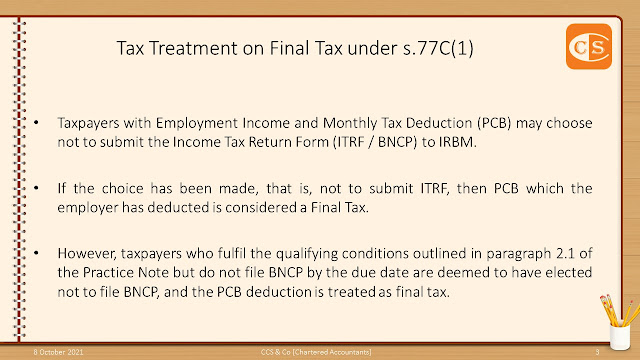

1. On 3 May 2021, the LHDNM issued a Practice Note to provide an explanation on the tax treatment of the Final Tax under the provisions of subsection 77C (1) of the Income Tax Act 1967 (ACP).

2. The Income Tax Return Form (ITRF / BNCP) is not required to be submitted to IRBM by taxpayers with one Employment Income ONLY for the year and Monthly Tax Deduction (PCB).

3. If the decision has been made not to file ITRF, the PCB that the employer has deducted is deemed a Final Tax.

🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼

1. 2021年5月3日,马来西亚税收局发布了一份应用指引 [Practice Note],就1967年所得税法令第77C(1)条文所规定的最终税 [Final Tax] 的税务处理提供解释。

2. 只有一份就业收入和每月扣 PCB 的纳税人,可以选择不向税收局提交所得税报表。

3. 如果已经做出不提交所得税报表的选择,那么雇主已经扣除的 PCB 将被视为最终税 [Final Tax]。

3. 下载阅读 - https://www.ccs-co.com/publications

#税务之道博大精深,#建议深度学习#FinalTax

🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳

👉 专业资讯送到你手中

1. 网站 ✍️ https://www.ccs-co.com/

2. Telegram ✍️ http://bit.ly/YourAuditor

3. Instagram ✍ http://tiny.cc/rojzrz

4. 部落格 ✍ https://ccsyourauditor.blogspot.com/

5. Google ✍ http://tiny.cc/9oussz

Labels:

Final Tax,

PCB,

What’s New?

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.