1. On September 8, 2021, the Malaysian government gazetted the following rules:

👉 Income Tax (Special Deduction for Rental Reduction to a Small and Medium Enterprise) Rules 2021 [P.U.(A) 353/2021]; and

👉 Income Tax (Special Deduction for Reduction of Rental to a Tenant Other Than a Small and Medium Enterprise) Rules 2021 [P.U.(A) 354/2021]

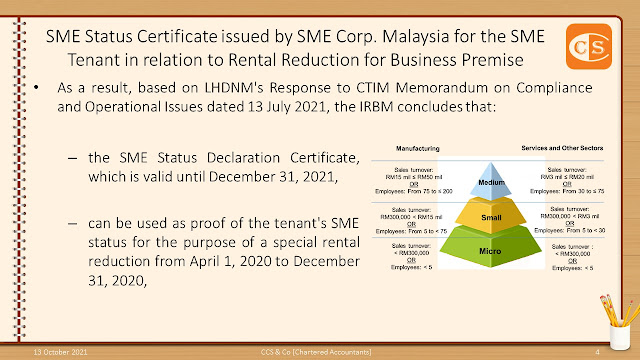

2. P.U.(A) 353/2021 applies where a business premise's tenant is a small and medium enterprise ("SME"), and is assumed to have taken effect in the assessment year 2020.

3. However, certificate by the SME Corp. Malaysia confirming the status of the small and medium enterprise as a supporting document is required.

🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼

1. 2021年9月8日,马来西亚政府在宪报中颁布了以下两个细则 [Rules]:

👉 2021年所得税 (中小型企业租金减免特别扣除) 细则 [Income Tax (Special Deduction for Rental Reduction to a Small and Medium Enterprise) Rules 2021, P.U.(A) 353/2021] ;和

👉 2021年所得税 (非中小型企业的租户租金减免特别扣除) 细则 [Income Tax (Special Deduction for Reduction of Rental to a Tenant Other Than a Small and Medium Enterprise) Rules 2021, P.U.(A) 354/2021] 。

2. 当营业场所的租户是中小型企业时, P.U.(A) 353/2021 才会被引用,并在 2020课税年度生效。

3. 然而,租户需要提供由马来西亚中小型企业公司 [SME Corp. Malaysia ] 出具的证书,以确认中小型企业的地位。

#税务之道博大精深,#建议深度学习

🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳

👉 专业资讯送到你手中

1. 网站 ✍️ https://www.ccs-co.com/

2. Telegram ✍️ http://bit.ly/YourAuditor

3. Instagram ✍ http://tiny.cc/rojzrz

4. 部落格 ✍ https://ccsyourauditor.blogspot.com/

5. Google ✍ http://tiny.cc/9oussz

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.