1. To improve compliance and governance, income tax deductions for secretarial and tax filing expenses have been merged and limited to a maximum of RM15,000 each year of assessment effective in assessment year 2020.

2. The Guideline dated 11 May 2021 revise the Guideline dated 18 September 2020 to explain the tax treatment of secretarial fees and tax filing fees, including filing fees for sales tax, services tax, levy, and tourism taxes.

2. The Guideline dated 11 May 2021 revise the Guideline dated 18 September 2020 to explain the tax treatment of secretarial fees and tax filing fees, including filing fees for sales tax, services tax, levy, and tourism taxes.

🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼

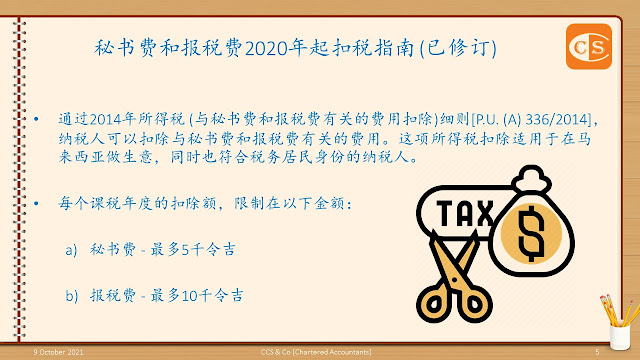

3. 为了提高合规性和管理水平,从2020评估年度开始,之前分开计算的秘书费和报税费的所得税扣税额,已经被合在一起并限制在每个课税年度不超过15千令吉。

4. 2021年5月11日的发出的指南,修订了2020年9月18日的指南,主要是解释秘书费和报税费 (同时包括:销售税、服务税、Levy 和旅游税的申报费)的税务处理。

5. 下载阅读 - https://www.ccs-co.com/publications

#税务之道博大精深,#建议深度学习

🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳

👉 专业资讯送到你手中

1. 网站 ✍️ https://www.ccs-co.com/

2. Telegram ✍️ http://bit.ly/YourAuditor

3. Instagram ✍ http://tiny.cc/rojzrz

4. 部落格 ✍ https://ccsyourauditor.blogspot.com/

5. Google ✍ http://tiny.cc/9oussz

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.