👉 all sorts of foreign income generated by individuals; and

👉 Dividend income received by companies and limited liability Partnerships [LLPs].

🌳 To Read - https://lnkd.in/ejScutM8

🌳 To Download - https://lnkd.in/e52r2UY2

2. This article was written before the press release was issued and has become less helpful with this press release, but can still be used as a reference for future reference

3. Join us on Telegram to stay up to date with the times - http://bit.ly/YourAuditor

🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻

1. 财政部于2021年12月30日发布新闻稿,政府已同意在符合某些条件后,海外收入豁免征税至2026年12月31日:

#税法之道博大精深,#建议大家深度学习

🌸🌸🌸🌸🌸🌸🌸🌸🌸🌸

#InternationalTax

#国际税收系列

According to a press release issued by the Ministry of Finance on 30 December, the government has agreed to exempt overseas income from taxation until 31 December 2026, subject to certain conditions.

根据财政部12月30日发布的新闻稿,政府已同意在符合某些条件后,海外收入豁免征税至2026年12月31日

🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼

#InternationalTax

#国际税收系列

1. Issue No. 103/2021: Finance Bill 2021 Highlights – No more Exemption on Foreign Sourced Income remitted to Malaysia

[2021年财政法案亮点 – 源自外国汇入马来西亚的收入,不再获得豁免]

https://lnkd.in/eCS24pA3

2. What Is International Tax?

[什么是国际税收]

https://lnkd.in/eiuiC4f4

3. International Organizations involved In International Tax - OECD

[涉及国际税收的国际组织 - 经合组织]

https://lnkd.in/e_uDSM-S

4. International Organizations involved In International Tax - G 20

[涉及国际税收的国际组织 - G 20]

https://lnkd.in/ehZnNjwh

5. International Organizations involved In International Tax - G20/OECD Inclusive Framework, World Bank Group & IMF

[涉及国际税收的国际组织]

https://lnkd.in/eKdW5UdE

6. International Organizations involved In International Tax - The UN

[涉及国际税收的国际组织]

https://lnkd.in/ermXNTq2

7. Residence Jurisdiction vs. Source Jurisdiction

[来源地管辖权 vs. 居民管辖权]

https://lnkd.in/eCit6_dc

8. Jurisdiction to Tax – The logic behind "Source Jurisdiction / Territorial Concept."

[税收管辖区 - "来源地管辖权"背后的逻辑]

https://lnkd.in/eyp-SY_k

9. Jurisdiction to Tax – The logic behind "Residence Jurisdiction."

[税收管辖区 - "居民地管辖权"背后的逻辑]

https://lnkd.in/eyzTrxpN

10. The Principle of Territorial-Residence Jurisdiction

[属地兼属人管辖原则]

https://lnkd.in/ehXXBXmd

11. Special Income Remittance Programme to Malaysian Residents – No more Exemption on Foreign Sourced Income remitted to Malaysia

[马来西亚居民收入汇款特别计划 – 源自外国汇入马来西亚的收入,不再获得豁免]

https://lnkd.in/ez4bpY3W

12. Double Taxation vs. Double Non-Taxation

[双重征税 vs. 双重不征税]

https://lnkd.in/etfYgkXK

13. Legal International Double Taxation

[法律性国际双重征税]

https://lnkd.in/e8zX9kP2

14. Methods used by Resident Countries to Cope with Double Taxation

[居民国应对双重征税的方法]

https://lnkd.in/e77aSCnE

15. Economic International Double Taxation

[经济性国际双重征税]

https://lnkd.in/ewWDxjZ3

16. Income Tax Treatment of Pensions (Provident Fund)

[退休金或公积金@所得税处理]

https://lnkd.in/eJVNzteR

17. Defining Residence

[居民身份@界定]

https://lnkd.in/eHfK49iB

18. An Individual’s Tax Residence under s 7(1)(a) ITA 1967

[1967年所得税法令第7(1)(a)条 @ 居民身份]

https://lnkd.in/eJHAdE_D

19. An Individual’s Tax Residence under s 7(1)(b) ITA 1967

[1967年所得税法令第7(1)(b)条 @ 居民身份]

https://lnkd.in/eT5HcfWH

20. An Individual’s Tax Residence under s 7(1)(b) ITA 1967 -Temporary Absences

[1967年所得税法令第7(1)(b)条 @ 居民身份 - - 暂时性不在]

https://lnkd.in/erW_Jxwd

21. Tax Residence under s 7(1)(c) ITA 1967

[1967年所得税法令第7(1)(c)条 @ 居民身份]

https://lnkd.in/eMw82gE9

22. Tax Residence under s 7(1)(d) ITA 1967

[1967年所得税法令第7(1)(d)条 @ 居民身份]

https://lnkd.in/eeYZy7Nq

23. Tax Residence under s 7(1A)ITA 1967 - A ‘day.’

[1967年所得税法令第7(1A)条 @ 居民身份: 一天的定义]

https://lnkd.in/eS4JVgCr

24. Move to tax Foreign-Sourced Income in Malaysia is not a surprise

[马来西亚对源自国外的收入征税 的举措并不令人意外]

https://lnkd.in/e-kqYmuq

25. Special Income Remittance Programme to Malaysian Residents

[源自外国汇入马来西亚的收入 特别报税方案]

https://lnkd.in/eqhVhXda

26. Work on board, e.g. as a sailor, Subject to Tax?

[在船上工作,如水手 中 Tax 吗]

https://lnkd.in/ee6bgchw

27. Work onboard - Deeming Provisions of Employment Income

[船员 - 就业收入认定条款 ]

https://lnkd.in/eZv55cdV

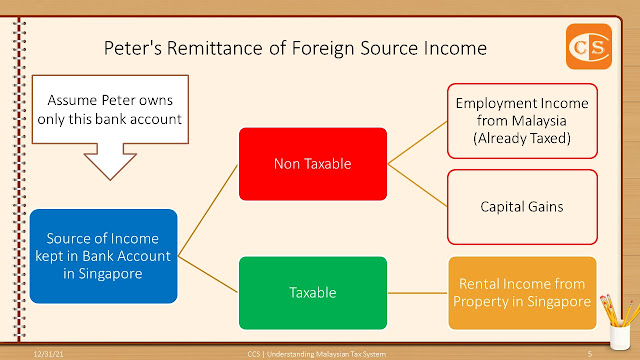

28. What Exactly is Considered a Taxable Remittance: 1 - Introduction

[究竟什么才会被认为是”应税汇款”: 1 – 概述]

https://lnkd.in/eKVzZqeQ

29. What Exactly is Considered a Taxable Remittance: 2 - Definition & Examples of Remittances

[究竟什么才会被认为是”汇兑”: 2 – "汇兑”的定义及例子]

https://lnkd.in/ewmKMjC5

30. What Exactly is Considered a Taxable Remittance: 3 - How do I know What Income or Gains I Have Remitted?

[究竟什么才会被认为是”汇兑”: 3 – 我如何知道 我汇兑了哪些收入或收益?]

https://lnkd.in/esiM6_ZX 31. What Exactly is Considered a Taxable Remittance: 4 - Should I Remit or Not?

[究竟什么才会被认为是”汇兑”: 4 – 我是否应该汇兑?]

https://lnkd.in/exSEf5nq

32. Tax Residents to be exempted from tax on the foreign-sourced income until Dec 31, 2026

[税务居民源自国外的收入将被免征税至2026年12月31日]

https://lnkd.in/eAu5rcJK

33. Termination of Special Income Remittance Program

[最新消息 - 源自海外收入特别汇款计划]

https://lnkd.in/euW8CJzm

🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼

#当你以我们的视频及刊物上的内容作为税务事务处理的参考时,你需要:

✅ 查询相关资料是否依然合时、准确和完整;和

✅ 寻求本身独立的专业意见,因为各别案例所涉及的范围和层面皆不同。

When you apply the content in our videos and publications as a reference, you need to:

🅾️ check the information contained therein, whether it’s up-to-date, accurate and complete, and

🅾️ seek your independent professional advice because the scope and extent involved in each case are different.

🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳

👉 Stay in touch with us

1. Website ✍️ https://www.ccs-co.com/

2. Telegram ✍️ http://bit.ly/YourAuditor

3. Instagram ✍ http://tiny.cc/rojzrz

4. Blog ✍ https://lnkd.in/e-Pu8_G

5. Google ✍ https://lnkd.in/ehZE6mxy

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.