1. To aid the affected parties, effective from year of assessment 2022 a one-time special tax known as Cukai Makmur be placed on companies other than MSMEs that generate substantial profits during the COVID-19 pandemic period, It is proposed that:

👉 The first RM100 million of chargeable income is taxed at a rate of 24%,

👉 while the remaining chargeable income is taxed at a rate of 33%.

2. Note that the Cukai Makmur is based on chargeable income and not on the net profit or turnover of the Company.

👉 The first RM100 million of chargeable income is taxed at a rate of 24%,

👉 while the remaining chargeable income is taxed at a rate of 33%.

2. Note that the Cukai Makmur is based on chargeable income and not on the net profit or turnover of the Company.

3. Download - https://www.ccs-co.com/publications

🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻

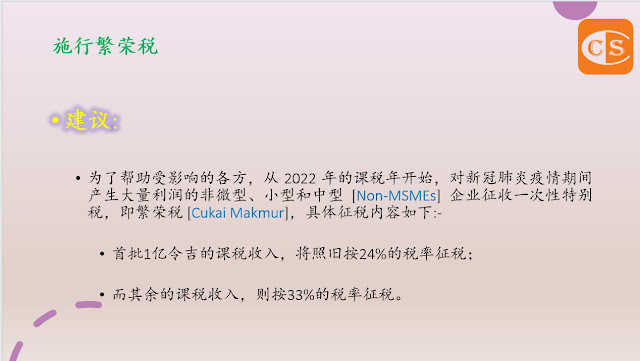

1. 为了帮助受影响的各方,从 2022 年的课税年开始,对新冠肺炎疫情期间产生大量利润的非微型、小型和中型 [Non-MSMEs] 企业征收一次性特别税,即繁荣税 [Cukai Makmur],建议:

👉 首批1亿令吉的课税收入,将照旧按24%的税率征税;

👉 而其余的可是收入,则按33%的税率征税。

🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻

1. 为了帮助受影响的各方,从 2022 年的课税年开始,对新冠肺炎疫情期间产生大量利润的非微型、小型和中型 [Non-MSMEs] 企业征收一次性特别税,即繁荣税 [Cukai Makmur],建议:

👉 首批1亿令吉的课税收入,将照旧按24%的税率征税;

👉 而其余的可是收入,则按33%的税率征税。

2. 注意,繁荣税是以课税收入 [chargeable income]为基础,而非以按照企业的净利或营业额征收

3. 下载 - - https://www.ccs-co.com/publications

🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳

👉 专业资讯送到你手中

1. 网站 ✍️ https://www.ccs-co.com/

2. Telegram ✍️ http://bit.ly/YourAuditor

3. Instagram ✍ http://tiny.cc/rojzrz

4. 部落格 ✍ https://ccsyourauditor.blogspot.com/

5. Google ✍ http://tiny.cc/9oussz

🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼

3. 下载 - - https://www.ccs-co.com/publications

🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳

👉 专业资讯送到你手中

1. 网站 ✍️ https://www.ccs-co.com/

2. Telegram ✍️ http://bit.ly/YourAuditor

3. Instagram ✍ http://tiny.cc/rojzrz

4. 部落格 ✍ https://ccsyourauditor.blogspot.com/

5. Google ✍ http://tiny.cc/9oussz

🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.