1. Under these Rules:

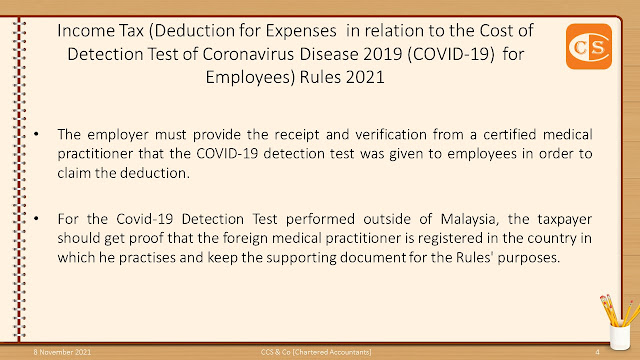

👉 Employer costs incurred between January 1, 2021, and December 31, 2021 will now be eligible for a further deduction. This means that a double deduction will be allowed for expenses incurred by an employer in a Covid-19 Detection Test carried out on its employee.

2. Download - https://www.ccs-co.com/publications

🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻

1. 在这项细则下:

👉 在2021年1月1日至2021年12月31日期间,雇主所支付的COVID-19 检测费,现在将享有额外扣除的资格。这意味着,雇主对其雇员进行的 Covid-19检测所产生的费用,将被允许进行双重扣税。

2. 下载 - - https://www.ccs-co.com/publications

🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳

👉 专业资讯送到你手中

1. 网站 ✍️ https://www.ccs-co.com/

2. Telegram ✍️ http://bit.ly/YourAuditor

3. Instagram ✍ http://tiny.cc/rojzrz

4. 部落格 ✍ https://ccsyourauditor.blogspot.com/

5. Google ✍ http://tiny.cc/9oussz

🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼

👉 专业资讯送到你手中

1. 网站 ✍️ https://www.ccs-co.com/

2. Telegram ✍️ http://bit.ly/YourAuditor

3. Instagram ✍ http://tiny.cc/rojzrz

4. 部落格 ✍ https://ccsyourauditor.blogspot.com/

5. Google ✍ http://tiny.cc/9oussz

🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.