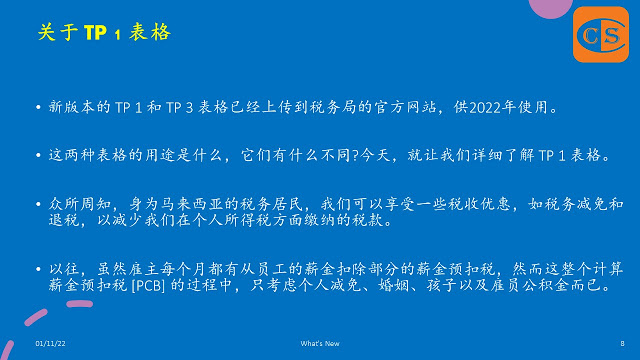

1. New versions of the TP 1 and TP 3 forms have been uploaded to the official website of the Inland Revenue Department for use in 2022.

2. What is the purpose of these two forms and how do they differ? Today, let's take a closer look at the TP 1 form.3. To download Form TP 1 & TP

🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻

1. 新版本的 TP 1 和 TP 3 表格已经上传到税务局的官方网站,供2022年使用。

2. 这两种表格的用途是什么,它们有什么不同?今天,就让我们详细了解 TP 1 表格。

3. 下载 TP 1 & TP 3表格 👉 https://t.me/YourAuditor/2579

🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼

[MIA 2020/2021年 的实践审查年度报告]

https://lnkd.in/eRAErf68

2. Special Income Remittance Programme to Malaysian Residents

[源自外国汇入马来西亚的收入 特别报税方案]

https://lnkd.in/eqhVhXda

3. Post-implementation Review of IFRS 9 — Classification and Measurement

[国际财务报导准则第9号之 施行后检讨 —分类及衡量]

https://lnkd.in/eKCRJa-r

4. Adoption of ISQM 1, ISQM 2 and ISA 220 (Revised)

[ISQM 1、ISQM 2 和 ISA 220 (修订版)的采纳]

https://lnkd.in/eDbqMREV

5. Movable Property Security Interest (MPSI) Bill

[动产担保权益法案]

https://lnkd.in/esFqwA-u

6. IFRS Foundation announcement on the International Sustainability Standards Board (ISSB)

[国际财务报告准则基金会关于国际可持续发展 准则委员会的公告]

https://lnkd.in/e_2ZVynM

7. MASB Updates No.1 November 2021 - IFRS Interpretations Committee (IFRIC) Agenda Decisions

[马来西亚会计准则委员会 [MASB] 2021年11月第1号更新 - 国际财务报告准则解释委员会(IFRIC)议程决定]

https://lnkd.in/enJNxX9Q

8. MASB Updates No.1 November 2021 - IASB Project on Equity Method

[MASB 2021年11月第1号更新 - 会计准则理事会关于权益法 [Equity Method] 的项目]

https://lnkd.in/eu3ZX_rB

9. Bursa Malaysia issues updated Corporate Governance Guide

[马来西亚证券交易发布更新的 公司治理指南]

https://lnkd.in/e5pEbgpt

10. Amendments to the By-Laws (on professional ethics, conduct and practice) of MIA

[对 MIA 章程 (关于职业道德、行为和实践)的修订]

https://lnkd.in/euRvPuNy

11. Labuan Business Activity Tax (Requirements for Labuan Business Activity) Regulations 2021

[2021年纳闽商业活动税 (纳闽商业活动的要求)条例]

https://lnkd.in/etg252Kb

12. Pembangunan Sumber Manusia Berhad (Exemption of Levy) (No. 2) (Amendment) Order 2021 [2021 年人力资源发展有限公司 (免征征税)(第 2 号) (修订) 指令]

https://lnkd.in/eGmGXRaU

13. Income Tax (Exemption) (No. 11) Order 2021

[2021年所得税 (豁免)(第11号) 指令]

https://lnkd.in/e5e-J8SV

14. Income Tax (Exchange of Information) Rules 2021 - Request for Information

[2021年所得税 (信息交流) 细则 - 要求提供信息]

https://lnkd.in/eUCUWXK6

15. Stamp Duty (Exemption) (No. 11) 2021 (Amendment) Order 2021

[2021 年印花税(豁免) (第 11 号)(修订) 指令]

https://lnkd.in/e_NxSBxF

16. Income Tax (Exemption) (No. 13) 2013 (Amendment) Order 2021

[2021年所得税 (豁免)(第 13 号) 2013年(修订) 指令]

https://lnkd.in/ejJyjQFs

17. Income Tax Double Deduction for the Sponsorship of Scholarship to Malaysian Student

[赞助马来西亚学生奖学金的 所得税双重扣税]

https://lnkd.in/eZp57-Vi

18. Double Deduction for Expenditure on Provision of Employees’ Accommodation

[雇员住宿费用双重扣税]

https://lnkd.in/eWPN2Yrn

19. Starting from the YA 2022, Company Secretarial and Tax Filing Fees can claim Deduction even not PAID

[2022课税年度开始,公司秘书费及报税费用,没还钱也可以扣税了]

https://lnkd.in/eKfh7fkz

20. “MIA SMPs Channel” – a Dedicated Telegram Channel for SMPs

[中小会计事务所 (SMPs) 专用 Telegram 频道]

https://lnkd.in/eKR9nf5v

30. Costs of Renovation and Refurbishment of Business Premise is allowable up to 31.12.2022

39. SST – Guide on Food & Beverages

[服务税 - 食品和饮料指南]

https://lnkd.in/ehRuruRa

40. SST – Guide on Parking Services

[服务税 - 停车场服务指南]

https://lnkd.in/emFT9Ven

41. SST – Guide on Motor Vehicle Services or Repair

[服务税 - 机动车服务或维修指南]

42. Double Tax Deduction for Expenditure in relation to Vendor Development Programme

[与供应商发展计划有关的支出双重扣税]

43. Tax Deduction for Investment in a Project of Commercialisation of Research and Development Findings

[研究与开发成果商业化项目投资 享有扣税资格]

https://lnkd.in/eZAfyv2S

44. FAQs on the implementation of Tax Identification Number, TIN

[这绝不是天上人间 而是TIN罗地网]

https://ccsyourauditor.blogspot.com/2022/01/issue-no-82022-faqs-on-implementation.html

🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳

👉 专业资讯送到你手中

1. 网站 ✍️ https://www.ccs-co.com/

2. Telegram ✍️ http://bit.ly/YourAuditor

3. Instagram ✍ http://tiny.cc/rojzrz

4. 部落格 ✍ https://lnkd.in/e-Pu8_G

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.