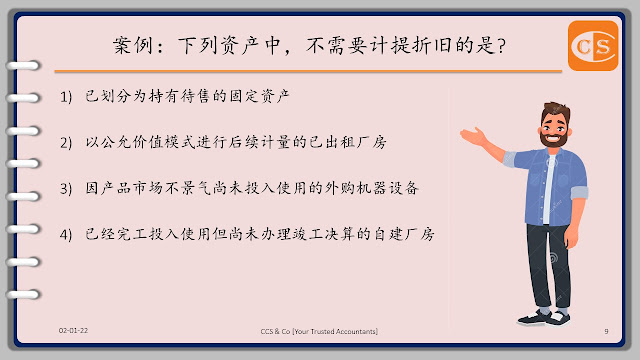

1. MFRS 116 适用于财产、厂房和设备的会计,但 除了以下 [第3段]:a) 在 MFRS 5 中被归类为持有用于销售的资产;

b) MFRS 141 中与农业活动相关的生物资产;

c) MFRS 6 中确认的勘探和评估资产;

d) 矿权和矿产储备,如石油、天然气和类似的非再生资源。

2. 然而,MFRS 116 适用于用于开发或维护 1 (b) – (d) 中所述的不动产、厂房和设备的资产

3. 在实践中,固定资产 [PPE] 包括:土地和建筑物、厂房、设备和机器、机动车辆、船舶、改进和翻新、在建工程、家具和配件等。

🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻

1. MFRS 116 applies to the accounting for property, plant and equipment, except [Para 3]:

a) assets classified as held for sale in MFRS 5;

b) biological assets related to agricultural activity under MFRS 141;

c) exploration and evaluation assets recognised in MFRS 6;

d) mineral rights and mineral reserves such as oil, natural gas and similar non-regenerative resources.

2. However, MFRS 116 applies to property, plant and equipment used to develop or maintain the assets described in 1 (b)–(d).

🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳

👉 专业资讯送到你手中

1. 网站 ✍️ https://www.ccs-co.com/

2. Telegram ✍️ http://bit.ly/YourAuditor

3. Instagram ✍ http://tiny.cc/rojzrz

4. 部落格 ✍ https://ccsyourauditor.blogspot.com/

5. Google ✍ http://tiny.cc/9oussz

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.